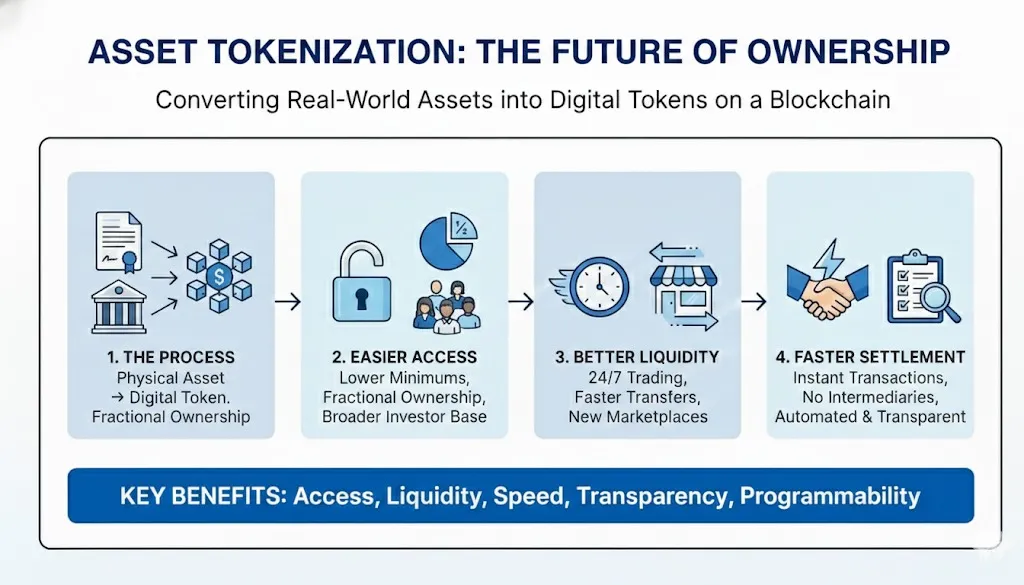

What is Tokenization?

Tokenization is the process of converting ownership rights of a real-world asset into digital tokens on a blockchain, which can represent full or fractional ownership of that asset. Unlike traditional asset ownership that uses paper documents and separate databases, tokenization stores ownership on a single, shared blockchain ledger that can be programmed with rules.

Easier Access and smaller ticket sizes

Traditional ownership often has high minimums and heavy onboarding.

- Funds, infrastructure, private credit, art, and real estate frequently call for lengthy account opening procedures and sizable checks.

- Many investors are just not invited in due to operational and legal disagreements.

Tokenization makes it possible to:-

- Fractional ownership: An asset’s economic rights can be divided into numerous little tokens. A modest chunk can be purchased by someone who could never afford an entire building.

- Greater distribution: Within legal bounds, the same token may be made available through a variety of platforms and channels after the structure and regulations are established.

Although regulations are still in place, this lowers operating costs by allowing more people to purchase smaller tickets.

Better liquidity for traditionally illiquid assets

Many assets, such as private funds, real estate, and unlisted equities, are “good” on paper but difficult to sell.

Traditional ownership depends on:

- Lawyers, bilateral agreements, and manual transfer documentation.

- Secondary markets that are either nonexistent or very shallow.

On the other hand, tokenized assets may be:

- Listed on regulated online marketplaces, which facilitate easier communication between buyers and sellers.

- Transferred not only during market hours but all day and all night.

- Settled swiftly, frequently in a matter of minutes rather than days.

Although it makes it much simpler to create secondary markets around previously locked-up assets, this does not ensure deep liquidity.

Faster, simpler settlement

The foundation of traditional asset ownership is:

- Several middlemen (clearing houses, registrars, brokers, and custodians).

- Batch processes and restrictions.

- Settlement cycles are often T+2 or longer.

Tokenization has the ability to combine multiple layers into one:

- Since the token ledger serves as the ownership record, settlement and transfer take place simultaneously.

- The ability to settle transactions almost instantly lowers operational and counterparty risk.

- Through smart contracts, corporate operations (such as interest payments or redemptions) can be carried out directly for token holders.

This is particularly beneficial for assets that have regular transfers or cash flows.

Programmable cash flows and ownership

Conventional contracts don’t change. People, paperwork, and frequently manual checks are necessary for any event or change.

Logic can be included in tokens:

- Automated revenue share, dividend, or coupon distributions.

- Rules governing who can own or trade the token, such as jurisdiction, investor type, and lockup periods.

- Conditional flows, such as money issued only if an oracle verifies a price event, milestone, or delivery.

In addition to reduced back office work, the outcome is innovative product concepts that are challenging to implement using spreadsheets and paper.

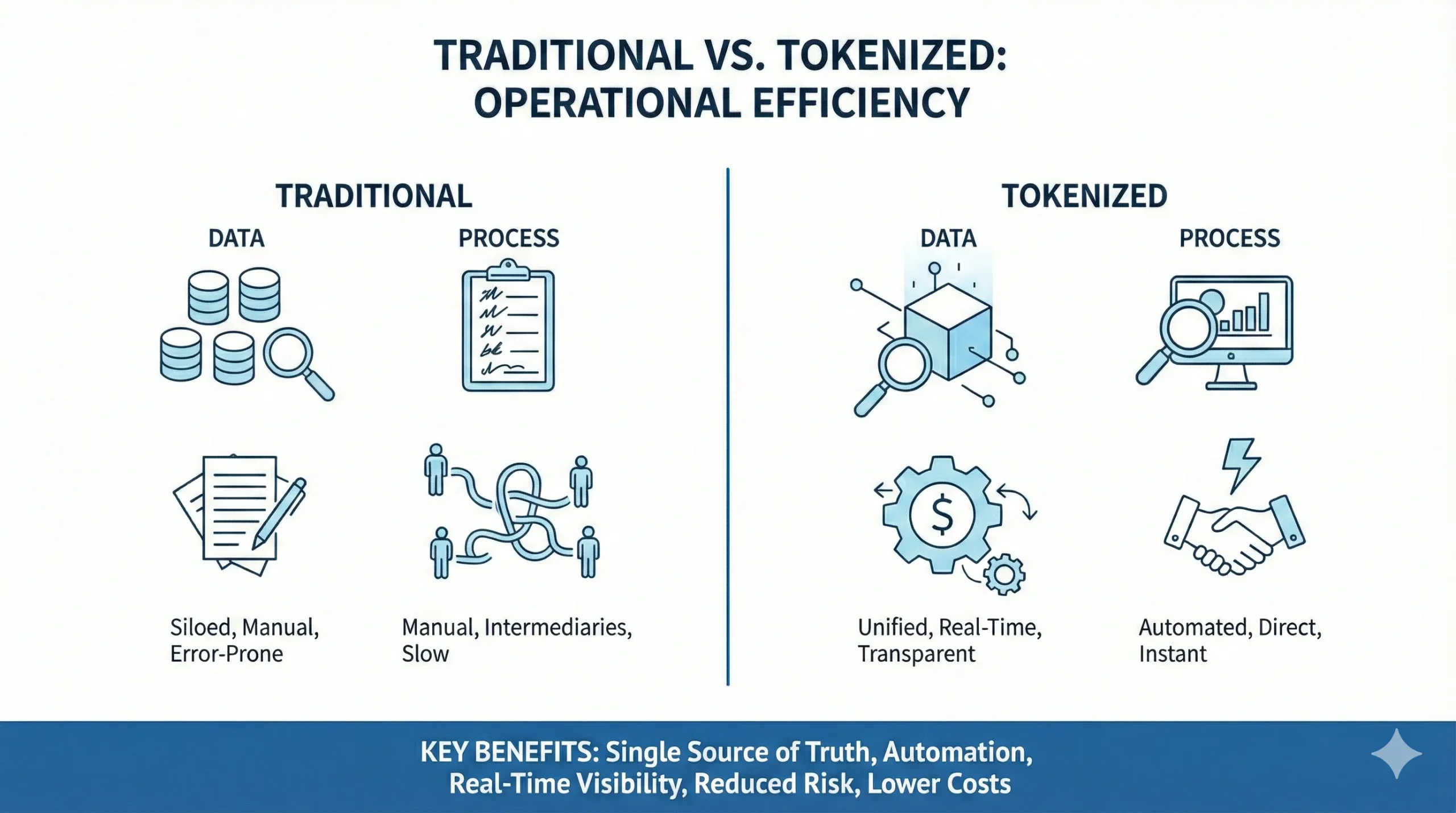

Improved transparency and auditability

Ownership of conventional assets can be unreliable:

- Position data is stored in several systems.

- Record reconciliation between parties is difficult and prone to mistakes.

- There is a lot of manual labour involved in audits.

A structure that uses tokens can provide:

- A single, communal ledger for transfers and token balances.

- Visibility in real time on specific flows, outstanding supply, and issuance size (subject to privacy design).

- Easier integration into risk, reporting, and analytics tools.

Although it provides a stronger basis for transparency, this does not inevitably improve data quality.

Operational efficiency and lower lifecycle costs

Traditional ownership involves the following:

- Several middlemen, each collecting a charge.

- Manual audits, checks, and signatures.

- Systems that were not designed to communicate with one another.

Tokenization makes it possible to:

- Complete processing, including lifecycle events, secondary trading, and primary issuance.

- Shared infrastructure, eliminating the need for parties to keep individual copies of the same document.

- Reduce marginal costs per investor or transaction over time, particularly at scale.

For institutions, lowering operational risk is just as important as lowering fees.

Where traditional ownership still matters

Tokenization is not automatically better in every situation.

It might be better to possess assets traditionally when:

- The token form would increase legal confusion, because regulations are still unclear.

- The advantages of secondary liquidity are limited by the small and steady investment base.

- Weak governance and technology lead to new attack surfaces and single points of failure.

A hybrid approach that combines standard legal frameworks and investor protections with a token platform for ownership and transfer records is frequently the best course of action.

Putting it together

In certain aspects, Tokenization is more beneficial over traditional ownership:

- Fractionalisation and access

- Possibility of liquidity

- Settlement ease and speed

- Programmability of cash flows and rights

- Openness and auditability

- Efficiency in operations across the asset lifespan

It makes no difference to the asset’s intrinsic value. It modifies the ease of creating, sharing, and transferring that value. The most important question for institutions and issuers is not “Tokenization or traditional ownership,” but rather which aspects of the ownership and settlement process are likely to benefit the most from switching to token rails and how to do so while adhering to current legal and regulatory frameworks.

Frequently Asked Questions

What does tokenization mean in finance?

Tokenization turns ownership rights in an asset (like real estate, bonds, or equity) into digital tokens on a blockchain that can be easily divided and transferred.

How is tokenization better than traditional asset ownership?

It can reduce settlement times, lower operational costs, and enable fractional ownership, making previously illiquid assets easier to access and trade.

Is tokenization legal in the US, EU, and India?

Generally yes, but under existing securities and payments rules. Each tokenized product must be structured to comply with local regulation.

What types of assets can be tokenised?

Real estate, bonds, fund units, private equity, invoices, commodities, and certain revenue streams, as long as legal rights are clearly defined.

Does tokenization guarantee more liquidity?

No. It makes trading easier and 24/7, but real liquidity still depends on investor demand, venue design, and regulation.

What are the main risks of tokenised assets?

Smart contract bugs, platform or issuer failure, regulatory changes, and low trading volume, plus operational risks around custody and governance.

How does tokenization change settlement and post trade?

Transfers and settlement can occur on the same ledger in near real time, reducing intermediaries and manual reconciliation.

How do institutions custody tokenized assets safely?

They use specialised digital asset infrastructure with secure wallets, policy based approvals, whitelists, and full audit trails integrated into existing systems.