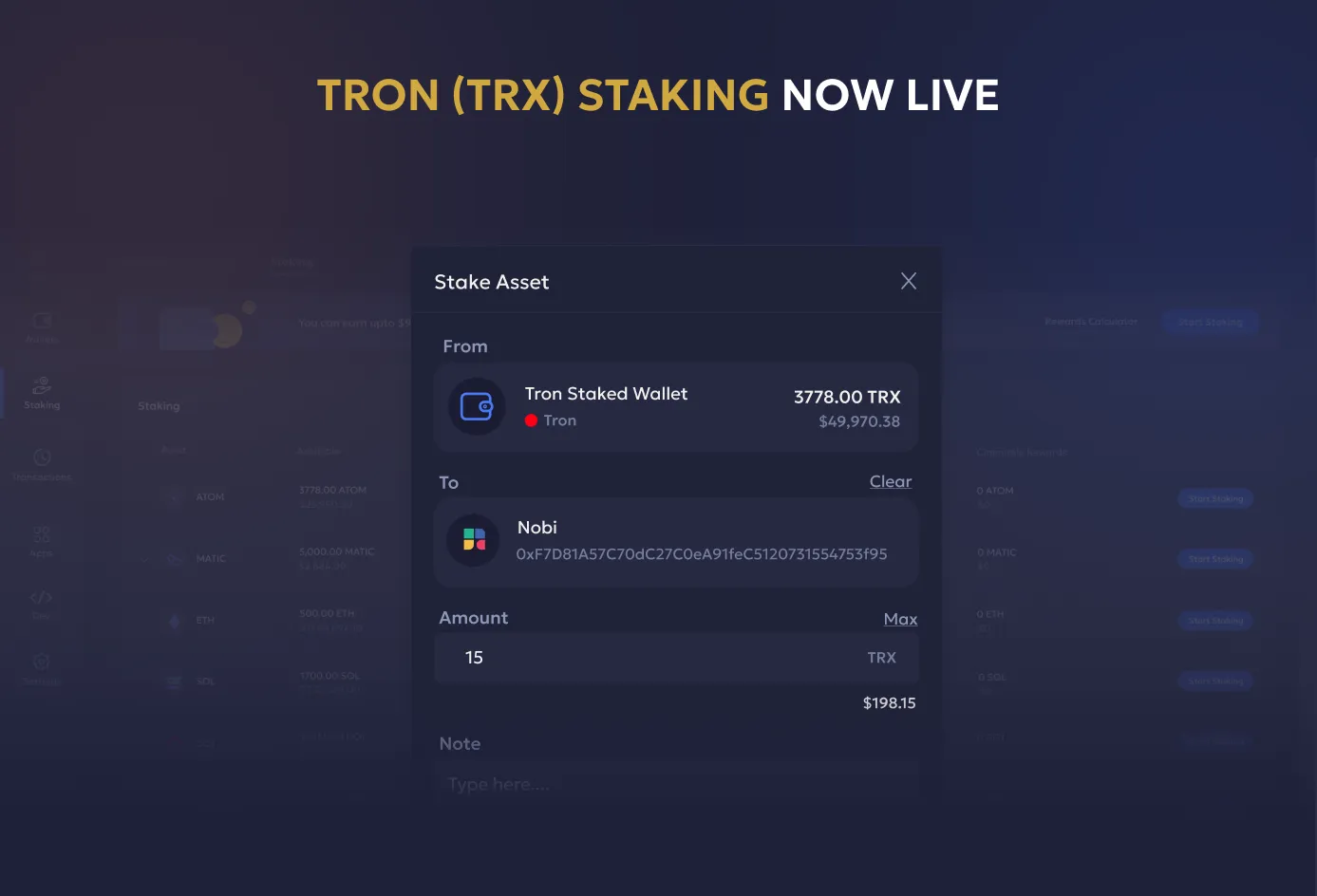

TRON (TRX) staking is the on-chain process of delegating TRX to a validator: Nobi Labs. This helps secure and operate the network in exchange for protocol rewards. Instead of transferring ownership, stakes are assigned to a validator. The validator – Nobi Labs – aggregates and delegates the stake to produce blocks. Then, a portion of the rewards earned at the protocol level is shared back with delegators. For institutions, this turns idle TRX into a yield-bearing, on-chain position.

Key Concepts

Bonding Period

The bonding period is the short window between submitting a stake and the moment that stake becomes active for rewards and governance. Operationally, this is when your stake is registered with the validator set and counted toward their consensus weight. Economically, it’s the “warm-up” during which rewards do not accrue yet.

Bonding is important for treasury planning because it defines how quickly idle TRX can be put to work. For example, a product may specify a 1-day bonding period. Treat bonding as a lead time: once you commit capital to staking, it will start earning only after the bonding completes.

Reward Accrual

After bonding, your delegated TRX participates in Nobi Labs’s reward stream. Rewards accrue based on the validator’s performance and network parameters. The APR (Annual Percentage Rate) varies with network conditions and the validator’s commission schedule. In practice, institutions should model gross vs. net APR (after commission), understand the cadence of accrual and distribution.

Unbonding Before Withdrawal

When you initiate an un-stake (full or partial), the position immediately stops earning and enters an un-bonding period. This cooling-off window serves two purposes:

- Network safety: preventing rapid stake churn that could destabilize consensus

- Operational integrity: providing time for orderly accounting

During un-bonding, funds are illiquid and cannot be redeployed. Treat un-bonding as a liquidity hold and use policy controls (amount thresholds, multi-approver releases, etc.) to manage exit risk.

The key takeaway is that

Bonding, reward accrual, and un-bonding define the lifecycle of staked TRX and the operational guardrails around it. Done well, TRON staking becomes a custody-native yield that delivers predictable and well-governed returns on idle TRX.

How it Works

Operationally, TRON uses a delegated proof-of-stake model with a defined validator set and voting. When you stake (often called “freeze” or “delegate” on TRON), you:

- Lock TRX for a bonding period

- Assign voting power to a validator

- Begin accruing rewards after the bonding completes.

Rewards are usually distributed on a periodic schedule and can be claimed to the same wallet that performed the delegation. Unstaking (redelegating back to self) initiates an “un-bonding window”, during which funds are illiquid and do not earn rewards.

After which the principal becomes withdrawable. Institutions should note that TRON’s resource model: staking can grant Bandwidth and Energy credits that offset transaction and smart-contract execution costs. This can materially reduce OpEx for high-volume programs.

How It’s Different

TRX staking is fundamentally different from lending or “yield” products because the source of return, the risk model, and the operating mechanics are protocol-native. Not credit or liquidity-dependent. When you stake TRX, you delegate tokens to a validator partner so they can help secure and operate the TRON network. In return, you earn protocol rewards that are shared pro-rata after the validator’s commission.

Your assets remain under your control in custody. Staking is an on-chain governance and security function rather than a financial contract with a borrower or platform.

Benefits of TRX Staking

From a custody standpoint, custody-native staking (for example, via MPC wallets) keeps assets in your controlled environment with maker & checker approvals and full audit trails. Many lending or yield strategies require moving assets out of custody to third-party smart contracts or centralized platforms, expanding your attack surface and governance complexity.

For Enterprise Stacks

The return drivers and forecasting are distinct. TRX Staking is a function of protocol reward rates, validator selection, and commission. Which is generally more stable for treasury planning. For B2B operators with idle TRX, staking can be the cleaner, governance-aligned way to monetize balances while maintaining control and auditability.

For enterprise custody stacks, staking operations can

- Deploy idle TRX into on-chain yield

- Maintain full control over keys and policy

- Reconcile rewards programmatically into finance systems

The result is a secure, compliant, and operationally efficient pathway to monetize TRX holdings.

Liminal x Nobi Labs

For institutions staking TRX through Liminal with Nobi Labs as validator, the value proposition goes beyond APR (Annual Percentage Rate). It’s about operational reliability by design. Nobi Labs’s validator operations are engineered for continuity with 24/7 monitoring to minimize missed blocks and reward volatility. In a treasury or exchange environment where staking is a standing position, that reliability translates directly into steadier realized yield and fewer operational interruptions.

With Nobi Labs, the core levers that affect your realized returns are visible and predictable. With published commission schedules, on-chain performance history, and clear reward distribution practices:

- Finance can reconcile accruals against on-chain data

- Risk and compliance can evidence validator selection and ongoing monitoring

- Operations can track bonding, un-bonding, and pending withdrawals with full event logs

This end-to-end observability shortens close cycles. With global recognition Nobi Labs drives confidence for the staking flow. Combined with Liminal’s custody-native execution, a resilient and audit-ready staking posture is created. You have a durable operating model for enterprise expectations with support.

Specs At A Glance

- APR: up to ~3.6% subject to network conditions

- Bonding time: 1 day after stake

- Unstaking: full or partial

- Unbonding: 14 days from un-stake request to withdrawal eligibility

- Reward claim: claim anytime; minimum 1 TRX to claim

- Wallet scope: supported on mobile/warm MPC wallets (Multisig is not supported for staking)

Don’t Idle

TRON staking turns idle balances into predictable, on-chain yield without taking on credit exposure to third parties. Staking also maps to enterprise security and governance. Unlike lending or off-platform yield strategies, there’s no counterparty solvency risk. From a portfolio construction perspective, TRX staking satisfies the contextual demand for a passive and secure yield. Enterprises gain a yield primitive that is resilient audit-ready. This answers the call of the moment for digital assets.